Lease vs Buy: Making the Right Decision for Your Next Vehicle

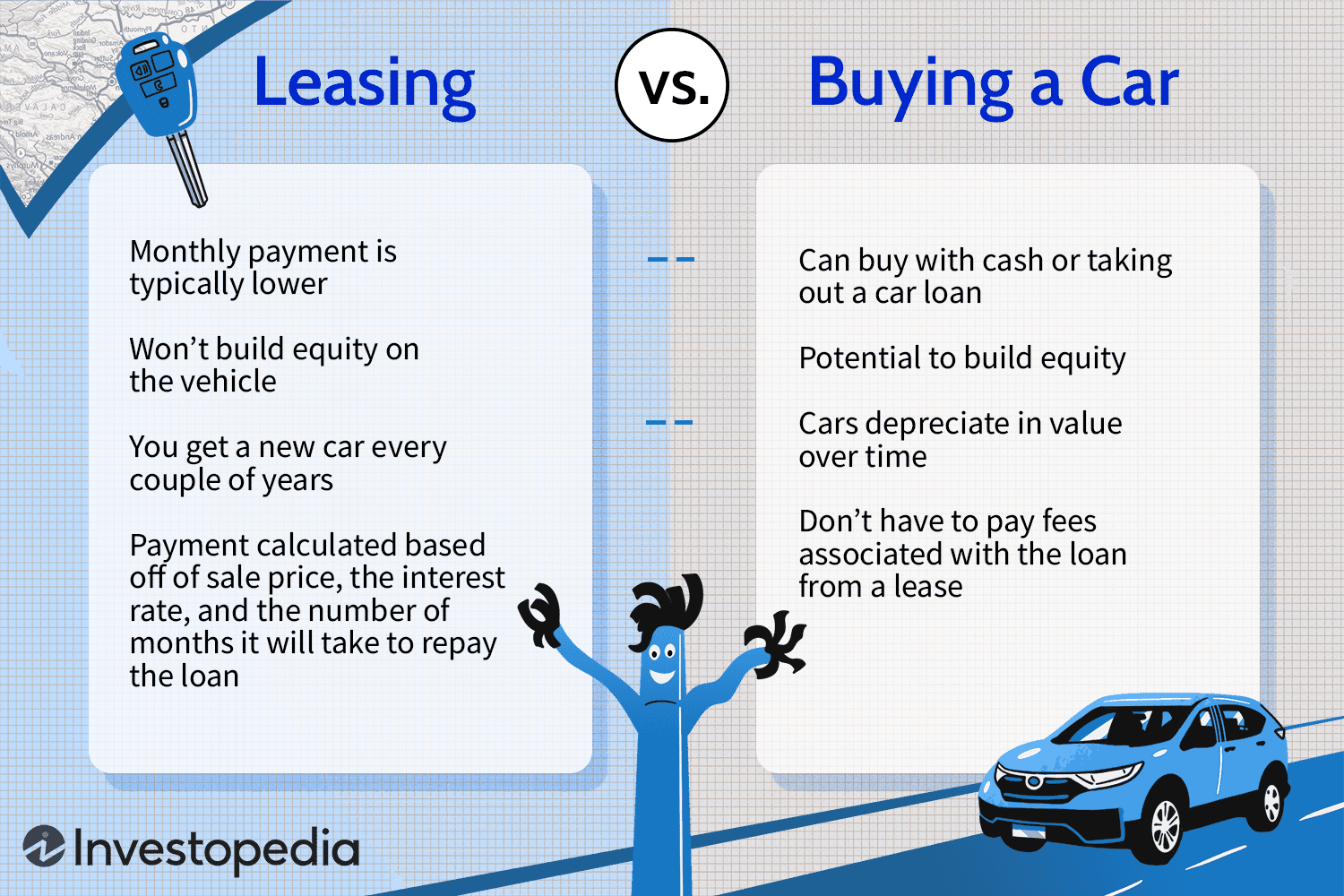

When it comes to acquiring a new vehicle, the lease vs buy dilemma is a common concern for many individuals. Understanding the pros and cons of each option is crucial in making an informed decision that suits your needs and budget. In this comparison post, we will explore the advantages and disadvantages of leasing and buying a car, helping you determine which option is best for you.

Pros and Cons of Leasing a Car

Advantages of Leasing

Leasing a car offers several benefits that may be appealing to certain individuals. These advantages include:

- Lower upfront costs: Leasing typically requires a lower down payment and lower monthly payments compared to buying a car.

- Access to newer models and technology: Leasing allows you to drive the latest models with the newest features and technology.

- Lower maintenance and repair expenses: Since leased vehicles are typically under warranty, maintenance and repair costs are often covered.

Disadvantages of Leasing

While leasing has its advantages, there are also some drawbacks to consider:

- Mileage restrictions: Most lease agreements come with mileage restrictions, and exceeding these limits can result in additional fees.

- No ownership or equity: When you lease a car, you do not own it, and you have no equity in the vehicle at the end of the lease term.

- Potential for additional fees at the end of the lease term: Returning a leased vehicle may incur fees for excessive wear and tear or exceeding mileage limits.

Pros and Cons of Buying a Car

Advantages of Buying

Buying a car also has its own set of advantages that may be more suitable for certain individuals. These advantages include:

- Ownership and equity: When you buy a car, you have full ownership and can build equity in the vehicle over time.

- No mileage restrictions: Unlike leasing, there are no mileage restrictions when you own a car.

- Freedom to customize and modify the vehicle: Buying a car allows you the freedom to customize and modify it to your liking.

Disadvantages of Buying

However, there are also disadvantages to buying a car that should be taken into consideration:

- Higher upfront costs: Buying a car typically requires a larger down payment and higher monthly payments compared to leasing.

- Depreciation and potential resale value loss: Cars depreciate over time, and when you decide to sell, you may experience a loss in resale value.

- Higher long-term maintenance and repair expenses: As a car ages, maintenance and repair costs tend to increase.

Factors to Consider When Deciding

When deciding between leasing and buying a car, it's important to consider various factors that can impact your decision. These factors include:

Financial Considerations

- Monthly budget and affordability: Evaluate your monthly budget and determine what you can comfortably afford in terms of lease payments or loan payments.

- Long-term cost analysis: Consider the long-term costs associated with leasing and buying, including insurance, maintenance, and potential savings.

- Financing options and interest rates: Explore financing options and compare interest rates to determine the most cost-effective solution for your financial situation.

Lifestyle Considerations

- Driving habits and mileage needs: Assess your driving habits and determine if you frequently exceed mileage limits imposed by lease agreements.

- Flexibility and customization preferences: Consider whether you value the flexibility to customize and modify your vehicle, which is more feasible when buying.

- Potential for life changes: Anticipate any potential life changes, such as job relocations or family expansions, that may impact your vehicle needs in the future.

Long-Term Goals

- Desire for vehicle ownership: Evaluate your desire for vehicle ownership and the importance of building equity in a car.

- Future plans for vehicle usage: Consider your future plans for vehicle usage, such as potential business needs or changes in family size.

- Resale value and potential trade-in value: Assess the potential resale value and trade-in value of a purchased vehicle compared to a leased one.

Making the Right Decision

To make the right decision between leasing and buying a car, it's essential to evaluate your needs and preferences, weigh the financial impact, and consider your future plans.

Evaluating Your Needs and Preferences

Assess your driving habits, lifestyle, and desired level of vehicle ownership. Determine whether the advantages of leasing or the benefits of buying align better with your needs and preferences.

Weighing the Financial Impact

Compare lease payments and loan payments to determine which option is more financially viable for you. Consider the long-term costs associated with each choice and potential savings.

Considering Future Plans

Evaluate your long-term goals and potential changes that may affect your vehicle needs. Determine how leasing or buying aligns with your future plans and the impact it may have on your overall financial situation.

Conclusion: Lease vs Buy: Which Option is Best for You?

In conclusion, the lease vs buy decision ultimately depends on your individual circumstances and priorities. Leasing offers lower upfront costs and access to newer models, while buying provides ownership and customization freedom. Factors such as financial considerations, lifestyle preferences, and long-term goals should be carefully evaluated to make an informed decision.

Remember, the right choice is the one that aligns with your needs and budget. Take the time to assess your situation and make a decision that suits you best.